Happy clients mean continued business and referrals—essential ingredients for success in private equity. But it’s not just about keeping your clients smiling; a sophisticated CRM caters to the evolving demands of stakeholders and the complexities of investment cycles. At its core, CRM for private equity is about maintaining client satisfaction.

A PwC Germany’s Private Equity Trend Report 2023 highlights the significance of cutting-edge digital tools like CRM systems. Almost all investors want to invest in digital capabilities, signaling that not adopting a CRM could leave you behind in this competitive landscape.

Say goodbye to the limitations of Excel spreadsheets and embrace the advanced capabilities of private equity CRM software.This software isn’t just a database; it’s a powerful tool that centralizes investor relations, portfolio monitoring, fund accounting, workflow automation, and team collaboration.

But with a vast market for CRM systems, how do you choose the right one for your firm?

We’ll delve into the world of private equity CRM, comparing key features of top software choices and providing insights on what to look for to help you transform your network of business relationships into a thriving ecosystem for success.

What is a CRM for Private Equity?

CRM for private equity is integral to simplifying and enhancing various aspects of private equity operations. A CRM software is an essential tool that seamlessly integrates with existing applications used by private equity firms.

It serves a multifaceted role, centralizing customer data storage in the cloud for easy access from any location. The software excels in various functions, including data management, automation, reporting, and analytics.

The Benefits of CRM for Private Equity

Let’s explore how this system can bring significant advantages to your firm.

- Seamless Email Integration: A CRM for private equity typically integrates with your team’s email, providing a unified view of all communications. This feature is incredibly useful in keeping track of interactions with clients and team members. The beauty of email integration lies in its ability to update records automatically, saving time and reducing manual efforts.

- Efficient Workflow Integration: One of the standout benefits of CRM for private equity is its ability to blend seamlessly into your existing workflows. This integration means less juggling between different programs for data logging, leading to enhanced efficiency. Many CRMs also come with mobile apps, allowing you to access and manage data on the go, boosting productivity significantly.

- Flexible System Integration: CRM for private equity shines in its ability to adapt to your current systems, whether integrating with other CRM tools or various business platforms. This flexibility is crucial as it minimizes the learning curve associated with new software and consolidates data from multiple sources into a single, accessible location.

- Advanced Data Enrichment: Data is a cornerstone for making informed investment decisions in the private equity sector. CRM for private equity aids in this by automating data entry and integration. It readily provides essential information like a company’s financials and transaction history at your fingertips. This capability reduces errors and saves valuable time, making your CRM a powerful asset in portfolio management and business development.

CRM for private equity is a comprehensive tool that enriches data management, streamlines communication, and integrates effortlessly with existing workflows and systems. Its role in simplifying complex processes and providing quick access to vital information makes it an indispensable asset for any private equity firm.

3 Compelling Reasons to Adopt a Private Equity CRM Today

In the ever-evolving investment world, staying ahead means adapting to modern tools. Private equity CRM systems have become indispensable, and here are three key reasons why every investor should consider using them:

- Enhanced Reporting for Informed Decisions

Today’s investment stakeholders are more actively involved than ever, seeking detailed reports on investments and deal sources. This level of granular reporting is challenging with essential tools like Excel. On the other hand, a private equity CRM system offers sophisticated data management, ensuring clean, accurate data for impactful reporting. This shift from essential tools to advanced CRM systems is not just an upgrade; it’s a necessity for maintaining credibility and securing deals.

- Adapting to Market Changes with Advanced Analytics

In an economic landscape marked by inflation and other market shifts, as noted by Bain & Company, merely having data is insufficient. Investors need data that is actionable. Private equity CRM software, equipped with AI-driven technology, provides comprehensive dashboards and insightful analytics. These tools enable investors to make informed predictions and stay ahead of market trends, turning raw data into a strategic asset.

- Managing Long-Term Relationships Efficiently

The private equity sector is characterized by long deal cycles, often 7 to 10 years, and involves numerous stakeholders. Managing such an extensive network of relationships without losing track is daunting. CRM tools in private equity come to the rescue by systematically organizing client information, linking it to relevant opportunities, and highlighting key communication points. This ensures that no vital connection or detail is missed over the lengthy deal process.

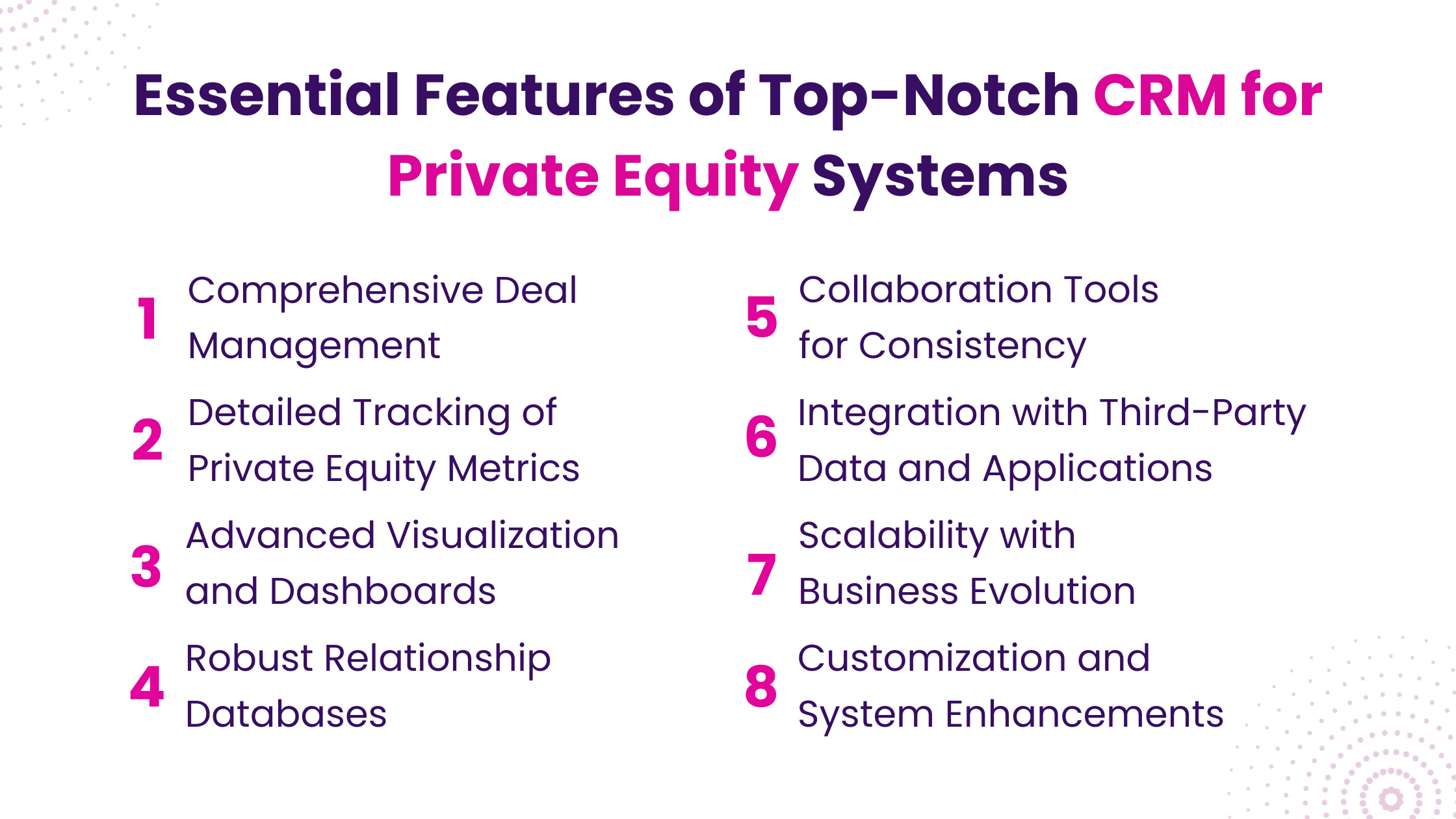

Essential Features of Top-Notch CRM for Private Equity Systems

The efficiency and effectiveness of your operations hinge significantly on the CRM system you employ. A top-tier CRM for private equity should be specifically designed to meet the unique needs of private equity investors and their intricate deal cycles, encompassing various contact types and workflows.

Below are the key features that define an ideal CRM for private equity:

1. Comprehensive Deal Management

A stellar private equity CRM must offer end-to-end deal management. This includes tracking potential acquisitions, managing due diligence, and overseeing post-investment activities. For instance, a platform like Salesforce can effectively handle these aspects when customized for private equity.

2. Detailed Tracking of Private Equity Metrics

Data-driven decision-making is pivotal. A proficient CRM for private equity should facilitate tracking vital metrics such as liquidity, MOIC, cash flow, IRR, and customer lifetime value. This feature gives investors a quick and clear view of company performance and helps them make informed decisions.

3. Advanced Visualization and Dashboards

Customizing visualizations and dashboards is crucial in a CRM for private equity. This feature ensures that relevant investment data is captured, analyzed, and visualized efficiently, aiding in monitoring the progress of investments and capital-raising activities.

4. Robust Relationship Databases

Effective management of relationships is the backbone of private equity. An exemplary CRM for private equity should offer comprehensive tools for tracking and nurturing relationships with partners and investors. This includes maintaining detailed profiles, monitoring communications, and understanding preferences.

5. Collaboration Tools for Consistency

Maintaining consistent communication across various parties is critical in private equity. A suitable CRM for private equity ensures interconnected efforts across teams, allowing everyone to access past communications and avoid repetitive or conflicting information.

6. Integration with Third-Party Data and Applications

Recognizing the diverse preferences of financial professionals, a functional CRM for private equity should allow for integrating preferred systems (like Outlook or Gmail) and essential data sources (such as Preqin or Pitchbook).

7. Scalability with Business Evolution

As businesses evolve, so should their CRM system. A CRM for private equity that can adapt and scale with the firm’s growth is essential. This ensures that the CRM continues to support its evolving needs without limitations as the firm expands.

8. Customization and System Enhancements

Since private capital investors have unique requirements, choosing a CRM system that allows for significant customization is crucial. This includes flexible dashboards, client profiles, and reporting tools tailored to specific investment processes. Salesforce, known for its high customizability, sets a benchmark.

Selecting the right CRM for private equity is a strategic decision that can greatly impact the efficiency and success of a firm’s operations. These features are key to ensuring that the chosen private equity CRM meets current needs and is well-equipped to adapt to future demands and challenges.

5 Best CRM for Private Equity in 2024

I. HubSpot

Image Source: HubSpot

- Cost-Effective Solution: HubSpot CRM is a great option for those seeking a cost-effective solution.The platform offers a free version, which is a significant advantage, especially for smaller teams or startups in the private equity sector.

- Team Support Across Functions: It supports various team functions, from marketing and sales to customer service. This versatility makes it an ideal CRM for private equity firms requiring a multi-faceted client relationship management approach.

- User-Friendly Interface: HubSpot CRM is known for its simplicity and ease of setup. Its user-friendly interface makes it accessible to teams of all sizes, ensuring a smooth transition and adoption within private equity firms.

- Limitations in the Free Version: While the free version offers many features, it’s important to note its limitations. Advanced features, which might be essential for some private equity operations, are available only in the paid versions.

- Interface Usability: Some users find the interface a bit challenging, especially when dealing with more complex tasks. This can be a minor drawback for private equity firms requiring more sophisticated CRM functionalities.

- Scalability and Pricing: HubSpot CRM scales well with your business growth, making it a sustainable choice for private equity firms. The pricing is free for up to 3 users, starting at $50 per month per user, allowing for cost planning according to team size and needs.

II. Salesforce

Source: Salesforce

- Industry-Leading Platform: Salesforce is acknowledged as a benchmark CRM platform known for its comprehensive capabilities. It’s particularly suitable for large private equity firms teams aiming to boost sales performance and client management.

- Extensive Customization and Integration Options: Offers vast customization possibilities, allowing private equity firms to tailor the platform to their specific needs. Features a wide range of integration options, including popular tools like Zoom, Dropbox, and Slack, facilitating a seamless workflow.

- Scalability for Growing Firms: It is highly scalable, making it a viable option for private equity firms looking to grow or expand their operations. Its ability to adapt to increasing demands and user bases is a significant advantage for dynamic private equity environments.

- Robust Feature Set: Equipped with an array of robust features designed to cater to diverse CRM needs in the private equity sector. These features encompass various aspects of client relationships and deal management, providing a comprehensive toolkit.

- Potential Drawbacks: The platform can be relatively expensive, which might be a consideration for private equity firms with tighter budgets. Its interface can be complex for some users, especially those unfamiliar with advanced CRM systems. This might require additional training and adjustment time.

- Cost Consideration: The pricing for Salesforce CRM starts at $25 per user per month.This cost factor is an important consideration for private equity firms when budgeting for CRM solutions.

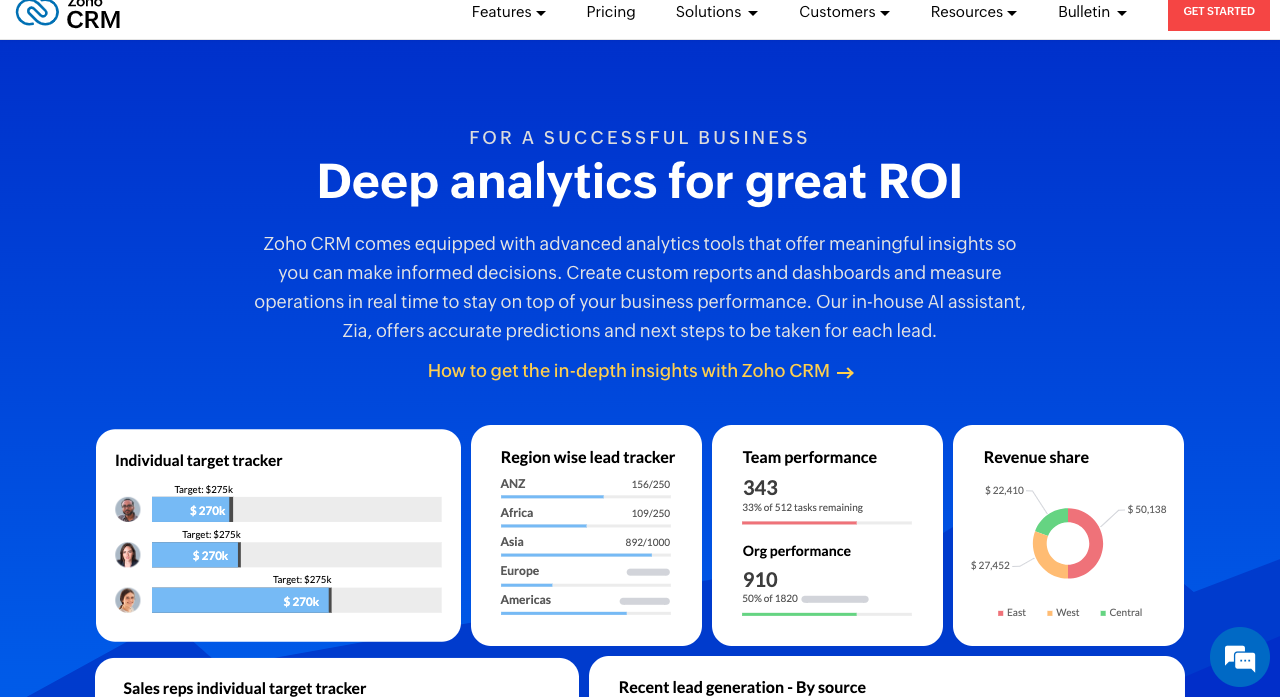

III. Zoho CRM

Source: Zoho CRM

- Ideal for Small to Mid-Sized Firms: Zoho CRM is well-suited for smaller or mid-sized private equity firms, offering a balance of functionality and affordability. Its pricing and feature set make it an attractive alternative to more expensive platforms like Salesforce.

- Affordable Pricing Structure: Zoho CRM is cost-effective, with pricing that ranges from $14 to $40 per month. This pricing model benefits private equity firms looking for a robust CRM solution without a large financial commitment.

- Enhanced Analytics Capabilities: Recent updates have bolstered Zoho CRM’s analytics features, an essential aspect for private equity firms in decision-making and strategy formulation. Improved analytics aid in better understanding market trends and client behaviors.

- Pros of Zoho CRM: The platform is known for its cost-effectiveness and ease of setup, making it an accessible option for CRM for private equity. Its user-friendly nature allows for quick adaptation and use by team members within a private equity firm.

- Cons to Consider: Zoho CRM has limitations in bulk attachment uploads, which could be a constraint for private equity firms handling large volumes of documents. Some of its functionalities are generic and might not cater specifically to the unique needs of private equity operations.

IV. Dynamo

Source: Dynamo

- Private Equity Specific Features: Dynamo is specifically designed for managing private equity investments. It includes essential features like deal management, investor relationship management, and due diligence processes, making it highly relevant for CRM for private equity.

- User-Friendly Interface: Known for its user-friendly interface, Dynamo allows for easy navigation and use, crucial for efficiency in private equity firms.

- Integration Options: Offers good integration capabilities with various software, facilitating seamless workflow within private equity operations.

- Limitations to Note: One notable drawback is the lack of an Android app, which might limit accessibility for some users. Dynamo has limited options for data entry, which could be a constraint for firms requiring extensive data input and management.

- Pricing Variability: The cost of using Dynamo varies significantly based on the specific needs and scale of the private equity firm.

V. DealCloud

Source: Deal Cloud

- Decade of Experience in Capital Markets: With its customizable SaaS solutions, DealCloud has served the capital market, including private equity firms, for over ten years.

- Management of Single-Source Deals and Relationships: It excels in managing single-source deals and maintaining relationships, key aspects of CRM for private equity.

- High Customization and Scalability: Highly customizable to fit the unique needs of private equity firms. Scalable to accommodate the growth and expanding requirements of a firm.

- Manual Data Input Requirement: Requires manual data entry, which could be time-consuming and might not suit all private equity firms.

- Extended Customization and Deployment Time: Customization and deployment can take up to six months, a potential drawback for firms seeking quicker implementation.

- Cost Considerations: DealCloud is positioned in the higher range of CRM costs, which might be a significant factor for budget-conscious private equity firms.

In the dynamic sector of private equity, the selection of a suitable CRM system is a strategic decision that significantly influences operational efficiency and client relationship management. The ideal CRM for private equity should align with the firm’s size, budget, and specific requirements, ensuring that it not only meets current needs but also adapts to future challenges and opportunities in the private equity landscape.

Unlock Your Business Potential With Expert HubSpot Support!

As a HubSpot Solutions Partner we take pride in assisting you with streamlining your HubSpot efforts. With our best-in-class marketing, sales, and service solutions, we help you scale exponentially.

INSIDEA’s HubSpot Specialists have the required in-depth knowledge and can provide you with expert guidance on how to use the platform to meet your specific business needs.

Get in touch today to learn more about how INSIDEA can help you succeed!

- Tailored Experience: For us, user experience is the primary focus. Thus, INSIDEA works with you to ensure your HubSpot experience is tailored to your business needs.

- Industry Expertise: Our team specializes in the setup, implementation, and optimization of HubSpot tools, as well as being well-versed in HubSpot best practices to ensure your business has the highest ROI possible.

- Customer Obsession: For us, customer satisfaction is the key to success, and we strive to ensure that our customers’ needs are not only met but exceeded every time.

At INSIDEA, we understand the importance of valuable HubSpot strategies that understand your target audience and drive conversions. Book a meeting with our HubSpot experts to explore how we can help you with your upcoming projects.

Get started now!