Today’s banking and finance clients have their minds on their money and their money on their mobiles. This means they are not only exposed to multiple security threats but also to endless financial options to choose from. Their demands are not much. They wish to stay secure, have fast transactions, a money-back guarantee over mishaps, and some discount offers. Well! These demands are certainly challenging to fulfill if your CRM for financial services is not in place.

But how can you choose which CRM is good for your business when there is a new tool in the market every day? In this blog, we will discuss the top features of a CRM that ticks most of your customer and security-facing checkboxes.

Why Do You Need CRM for Financial Services?

CRM for financial services is software that helps you see the bigger picture with your customer interaction and nurturing framework. With its data and insights, you can understand your customers and their requirements more effectively. Below are a few reasons that will help you understand the importance of CRM for financial services:

- Complete Customer View

A CRM gives you a full picture of your customers’ interactions, transactions, and preferences, which is essential for personalized service in finance.

- Tracking Campaigns

You can monitor the performance of your marketing campaigns, see what’s working and what’s not, and adjust your strategies accordingly.

- Data Management

A CRM handles large volumes of customer data efficiently, ensuring that all information is organized and accessible when you need it.

- Improved Relationships

By leveraging the insights provided by a CRM, you can enhance your interactions with customers, leading to stronger, more trusting relationships.

- Compliance and Reporting

Financial services require strict compliance with regulations. A CRM can help ensure that you’re following all the rules and make reporting much easier.

- Sales Opportunities

With a clearer understanding of your customers, you can identify new sales opportunities and offer relevant financial products and services.

- Service Improvement

CRMs often come with tools to help you measure customer satisfaction and feedback, which you can use to improve your services.

- Risk Management

By having all customer data in one place, you can better assess and manage risk, a critical aspect of financial services.

In short, a CRM is not just about managing current customers; it’s a comprehensive tool that helps financial service providers understand their clients, streamline their operations, and grow their business responsibly.

CRM for Financial Services – Top 7 Things to Keep in Mind

Any customer relationship management software is designed to help institutions manage their customer relationships. But when it comes to finances, the required feature list grows a bit longer than other industries.

By the way, the primary goal of a CRM for financial services is to improve customer relationships, streamline processes, and increase sales. But, given the unique needs and challenges of the financial sector, these CRMs are tailored to address specific requirements.

Here’s a breakdown of what you should know:

- Data Security: Given the sensitive nature of financial data, choose CRMs that prioritize security, ensuring that customer data is protected from breaches and unauthorized access.

- Compliance Management: Financial institutions have to adhere to various regulations. Getting CRM solutions that could cater to this sector often includes features that help ensure compliance with these regulations.

- Segmentation: Categorizing customers based on income, investment preferences, risk appetite, etc. It is crucial to provide better services.

- Task Automation: Automation helps in routine tasks like sending out reminders for policy renewals, payment alerts, etc.

- Integration: Get a CRM that can be integrated with other systems like core banking systems, trading platforms, and other financial tools.

- Analytics and Reporting: Provides insights into customer behavior, sales performance, and other key metrics.

- Document Management: Get a CRM that helps in storing and managing important documents like KYC forms, investment proofs, etc.

Top Benefits of Having a CRM for Financial Services

In the above section, we got to know the crucial features any CRM for financial services requires. Now, let us discuss the benefits of having CRM software.

- Enhanced Customer Service: By having all customer information in one place, financial service providers can offer personalized services and address issues more efficiently.

- Increased Sales: Financial institutions can cross-sell and up-sell products more effectively by understanding customer behavior and preferences.

- Efficiency: Reduces manual tasks and streamlines processes, leading to time and cost savings.

- Risk Management: Helps in identifying potential risks and fraudulent activities by analyzing transaction patterns and customer behavior.

Challenges with CRM You Should Know

So, these are the core offerings you need to consider while considering a CRM for financial services. But the road to all accomplishments is not without some hiccups. Hence, let us present to you some of the most common challenges that can occur with general CRM tools. Here is an overview of these challenges:

- Data Privacy Concerns: Handling sensitive financial data requires stringent data protection measures.

- Integration Issues: Integrating the CRM with existing systems can sometimes be challenging, especially if the systems are outdated.

- User Adoption: Like any other tool, the success of a CRM system depends on how well it’s adopted by its users. Training and change management are crucial.

- Customization: While there are off-the-shelf CRM solutions available, many financial institutions opt for customized solutions to cater to their specific needs.

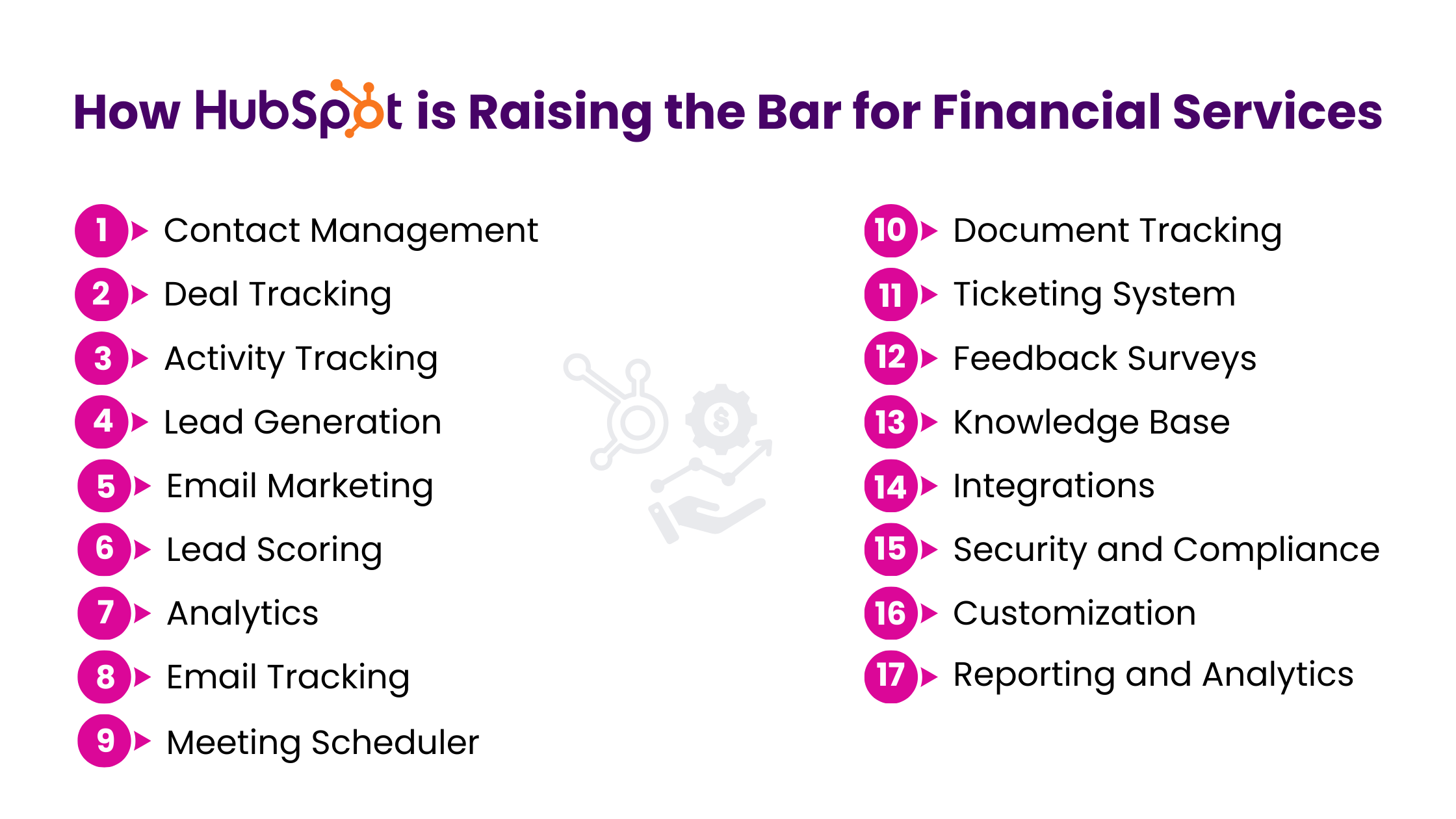

How HubSpot is Raising the Bar for Financial Services

HubSpot is not just a CRM but a combination of a CMS tool with an umbrella of functionalities.

It is a comprehensive inbound marketing, sales, and service platform that offers a wide range of tools and functionalities, including a CRM system. And it’s really easy to tailor its services to fit the needs of any industry. HubSpot’s flexibility and extensive feature set make it a viable option for businesses in this sector. So, in this section, we will discuss what makes HubSpot the best choice for financial services. Here’s what HubSpot can offer for financial services:

- Contact Management: Store detailed contact records, track interactions, and segment contacts based on various criteria.

- Deal Tracking: Monitor the progress of deals or opportunities, from lead generation to closure.

- Activity Tracking: Set reminders, schedule meetings, and track interactions with clients.

- Lead Generation: Use landing pages, forms, and pop-ups to capture leads.

- Email Marketing: Send targeted email campaigns, newsletters, and automated email sequences.

- Lead Scoring: Prioritize leads based on their engagement and likelihood to convert.

- Analytics: Track the performance of marketing campaigns, website traffic, and more.

- Email Tracking: Get notifications when a prospect opens an email.

- Meeting Scheduler: Allow clients to book meetings directly from an email or a webpage.

- Document Tracking: Know when a prospect opens a document, such as a financial proposal.

- Ticketing System: Manage customer inquiries, complaints, or service requests.

- Feedback Surveys: Collect feedback from clients to improve services.

- Knowledge Base: Create a self-service portal where clients can find answers to common questions.

- Integrations: HubSpot offers a vast ecosystem of integrations. Financial services firms can integrate HubSpot with their existing tools: accounting software, financial planning tools, or other specialized systems. HubSpot’s API also allows for custom integrations if needed.

- Security and Compliance: HubSpot invests in security measures to protect user data. While it may not have features specifically tailored for financial services compliance, businesses can implement additional measures and processes to ensure they remain compliant while using HubSpot.

- Customization: HubSpot allows for extensive customization, enabling financial services firms to tailor the platform to their needs. Use personalization tokens to tailor communication to individual clients based on their data and behavior.

- Reporting and Analytics: Get insights into sales performance, marketing campaign effectiveness, and customer behavior. Create custom dashboards to monitor key metrics relevant to financial services.

Unlock Your Business Potential With Expert HubSpot Support!

CRM for financial services is an essential tool for modern finance business. While HubSpot is a versatile platform you can customize based on your services, having a professional by your side is still essential to making the most of this CRM.

That’s where INSIDEA steps in. We come with a proven track record of tailoring HubSpot for the services your business entails. Our approach is simple: we ensure organizations adopt and thrive in HubSpot’s services.

As a HubSpot Solutions Partner, we take pride in assisting you with streamlining your HubSpot efforts. With our best-in-class marketing, sales, and service solutions, we help you scale exponentially. INSIDEA’s HubSpot Specialists have the required in-depth knowledge and can provide you with expert guidance on how to use the platform to meet your specific business needs.

Get in touch today to learn more about how INSIDEA can help you succeed!

- Tailored Experience: For us, user experience is the primary focus. Thus, INSIDEA works with you to ensure your HubSpot experience is tailored to your business needs.

- Industry Expertise: Our team specializes in the setup, implementation, and optimization of HubSpot tools, as well as being well-versed in HubSpot best practices to ensure your business has the highest ROI possible.

- Customer Obsession: For us, customer satisfaction is the key to success, and we strive to ensure that our customers’ needs are not only met but exceeded every time.

At INSIDEA, we understand the importance of valuable HubSpot strategies that understand your target audience and drive conversions. Book a meeting with our experts to explore how we can help you out with your upcoming projects.