With financial tools at their fingertips, today’s banking consumers seamlessly navigate from researching credit card choices on their computers to securing pre-approvals for loans via their smartphones. Such shifts highlight the digital era’s impact on reshaping the banking experience.

However, as the number of available options increases, it is not uncommon for customers to seek services from multiple banks. A homeowner could have a mortgage with one financial institution, a personal loan with another, and multiple credit cards with various institutions and retailers.

Adapting to customer needs and the competitive environment is vital for banks, and this is where CRM for banks becomes an invaluable asset. This technology is pivotal in managing and improving customer interactions, ensuring a more personalized and efficient banking experience.

In this blog, we’ll explore the essentials of CRM for banks, highlighting its significance and the key features that make it indispensable in today’s digital banking era. In addition to this, we’ll discuss 5 amazing CRM solutions for banks to maximize efficiency and revolutionize your customer management.

What is a CRM for Banks?

A CRM for banks is a centralized system that integrates with other banking software to provide an all-encompassing view of each customer’s account. It documents all consumer interactions, such as deposits, loan requests, and other predetermined actions.

It is a banking-specific software application that assists banks in managing consumer interactions and relationships. It enables banks to comprehend the requirements and preferences of their customers, automate and streamline key processes, and provide a more personalized customer experience.

A CRM for banks typically integrates with fundamental banking systems and marketing automation tools to provide a comprehensive view of customer interactions and data. It can also assist banks in engaging customers across multiple channels, including email, social media, and mobile, and provide real-time insights into consumer interactions and feedback.

Why Implement a CRM for Banks?

Let’s begin by establishing why your company should be interested in a CRM for banks.

A CRM solution enables banks to manage their sales pipeline, customer relationships, and marketing initiatives in a unified manner.

These could be possible reasons to implement CRM in your organization:

1. Combined Customer Information

One of the primary reasons for implementing software such as a banking CRM is to eliminate disparate information sources and centralize customer data and the history of all communications into a single database.

You want to be able to monitor all interactions with customers, whether they occur via phone, text message, or email. A CRM facilitates this and more.

In addition to fundamental client information and a communication summary, you can integrate it with other systems and view loan history, ATM deposits, and other information pertinent to providing better services.

2. Individualization Abilities

A CRM for banks is more than just a reliable database. All of this accumulated information can be used to customize services. By applying data analytics to a CRM’s client information, you can rapidly identify client preferences and suggest products that may meet their requirements.

Increasing your personalization efforts will increase customer loyalty and satisfaction. This will have a positive impact on your bottom line.

3. Customer Conduct Prediction

Another significant advantage of utilizing a CRM for banks is the ability to predict customer behavior based on the collected data. With artificial intelligence and predictive analytics, potential churn risks can be swiftly identified. Consequently, you can make a timely offer to help you retain them.

Thus, it becomes imperative for the banking sector to have a CRM system for enhanced productivity and hassle-free service to customers

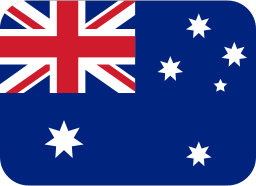

The Top 6 Features Every CRM for Banks Should Have

In the rapidly evolving banking sector, a robust CRM serves as a linchpin for delivering superior customer experiences. As financial institutions seek to differentiate themselves in a crowded marketplace, they must adopt CRM features tailored to their unique needs.

These features streamline operations and facilitate informed decision-making, personalized service, and strategic growth. Explore the essential features banks should prioritize when selecting a CRM system.

1. Complete Customer View

A central feature of CRM for banks is providing a 360-degree view of each customer, combining interactions, transactions, and credit scores. By having this centralized and up-to-date data, banks can offer more effective and personalized services to their clients.

Such a holistic approach not only streamlines the banking process but also significantly enhances customer satisfaction and loyalty.

2. Lead Management

In the banking sector, an integral aspect of a robust CRM system is its lead management capabilities. By streamlining the processes of lead qualification, scoring, and nurturing, banks can more efficiently identify and engage with promising prospects.

Furthermore, incorporating AI-driven functionalities within CRM for banks allows for more targeted upselling and cross-selling opportunities. This not only personalizes the service offered to each client but also has the potential to significantly increase revenue, making it a vital tool in modern banking.

3. Workflow Automation

By automating routine tasks, a CRM alleviates the burden of manual processes, allowing for more efficient operations in banks. This is particularly beneficial in managing customer interactions, where automated reminders for non-responsive leads ensure consistent engagement.

Such automation not only streamlines workflow but also minimizes the likelihood of overlooking important client interactions, thereby maintaining a high standard of customer service and organizational efficiency.

4. Marketing Campaign Coordination

The functionality of a CRM for banks extends beyond sales. These systems play a crucial role in orchestrating targeted marketing campaigns aimed at distinct customer segments. By using the rich data stored within CRMs, banks can identify potential customers for new offerings, ensuring that marketing efforts are efficient and effective.

Additionally, the integration of marketing dashboards within CRM systems enables banks to monitor and evaluate the effectiveness of their campaigns closely. This aids in fine-tuning current marketing strategies and provides valuable insights to guide future marketing endeavors, ensuring that banks remain aligned with their customers’ evolving needs.

5. Analytics and Reports

In the banking sector, a superior CRM system is distinguished by its ability to centralize data and provide analytical insights into sales and marketing performance. This feature is crucial for banks as it offers comprehensive insights into various key aspects such as revenue levels, the effectiveness of marketing campaigns, and staff efficiency.

The power of analytics and reporting in CRM systems lies in their ability to be customized, enabling banks to tailor reports and dashboards according to their specific needs. This ensures that banks can make data-driven decisions and strategize effectively, aligning their operations with their business objectives and customer needs.

6. Integration Support

The diverse array of applications and platforms used in banking demands that a CRM not only coexists but synergizes with these systems. Integration support is a critical advantage, as it ensures seamless access to data across various platforms. By facilitating this interconnectedness, banks can enhance their operational efficiency and improve their decision-making processes.

The Challenges of Adopting a CRM for Banks

CRM plays an instrumental role in streamlining operations and enhancing client experiences. However, adopting and integrating these advanced systems isn’t without its challenges.

From safeguarding sensitive client data against cyber threats to ensuring compatibility with older IT frameworks, banks face a set of unique hurdles. Here, we delve into some of the most pressing challenges and their optimal solutions when it comes to implementing a CRM for banks:

1. Data Security

Challenge: The banking sector prioritizes data security due to the sensitive nature of client information and account records. The industry demands stringent controls to safeguard against cyberattacks and malicious software.

Solution: Modern CRM platforms recognize these security concerns and offer robust measures. Features such as role-based access permissions, encrypted transactions, and regular data backups ensure high information security.

2. Integration with Legacy Systems

Challenge: Many financial institutions operate on legacy IT infrastructures that may need to be compatible with contemporary CRM systems. Integrating new solutions without causing data loss or system failures can be daunting.

Solution: CRM specialists, like HubSpot, possess the expertise to integrate modern CRM systems into existing infrastructures seamlessly. They ensure that the new solution is integrated without disruptions and functions optimally.

The banking sector should prioritize CRM adoption. The absence of the data visibility that CRM offers can lead to significant losses in clientele and profits. Moreover, banks can only analyze customer behavior effectively with comprehensive customer data or deliver the high-quality services that clients expect.

5 Best CRM for Banks: Streamlining Customer Engagement and Services

CRM for banks offers a range of functionalities, from customer data management to multi-channel communication. Below, we explore the features and benefits of some of the best CRM software for banking, providing a detailed overview of each.

1. EngageBay

Image Source: EngageBay

- All-in-One CRM Solution

Engagebay CRM offers a comprehensive solution by integrating marketing, sales, and service tools into a single platform. It’s designed to streamline various business processes, making it easier for teams to collaborate and access the information they need all in one place.

- Omnipresent Communication Channels

The CRM supports multiple communication channels, ensuring businesses can connect with customers wherever they are. This includes traditional methods like email and phone, as well as modern avenues like SMS, live chat, and social media platforms. This versatility allows banks to engage with their customers on their preferred channels.

- Drag-and-Drop Builder for Landing Pages and Forms

An easy-to-use drag-and-drop builder is included for creating landing pages and forms. This feature is user-friendly and does not require technical skills, making it accessible to all team members. Additionally, it offers A/B testing capabilities, allowing banks to optimize their web pages for better performance and user engagement.

- Customer Service Tools

The CRM comes equipped with various customer service tools to enhance efficiency and response time. These include autoresponders for quick replies, canned responses for common queries, a help desk for managing customer issues, and a ticketing system to track and resolve customer service requests effectively.

- Powerful Integrations

Compatibility with popular platforms like JustCall, Stripe, Zapier, Shopify, and Quickbooks is a significant feature. These integrations allow for seamless synchronization with other tools and services, enhancing the CRM’s functionality and making it a more powerful tool for managing various aspects of a banking business.

- Target Audience

This CRM solution is ideally suited for small to medium-sized banks and financial institutions. Its features and capabilities are tailored to meet the specific needs and challenges of these organizations, helping them to manage customer relationships more effectively.

- Pricing Structure

The CRM offers flexible pricing options, including free plans that cater to businesses with basic needs. For more advanced features, paid plans are available, starting at $14.99 per month. This tiered pricing structure makes it accessible for businesses of different sizes and with varying budgets.

2. HubSpot

Image Source: HubSpot

- Free Core CRM

HubSpot allows you to use the basic features of the Customer Relationship Management (CRM) software without any cost. It’s like getting the essential tools to manage customer information and interactions for free.

The software offers a system for drip campaigns. This is like a series of automated emails sent over time to build a relationship with potential customers (leads) gradually.

- Content Optimization

This feature helps you improve your content and make sure it’s more likely to show up in search engine results (SEO). It’s like having a tool that suggests changes to your online content so more people can find it easily.

- Multichannel Marketing

This is about creating webpages (landing pages) where visitors can learn more about your product or service, testing different versions of these pages to see which works best (A/B testing), dividing your customers into different groups based on their interests or behaviors (customer segmentation), and sending them content that’s specifically tailored to them.

- Target Audience

The CRM is particularly designed for big banks or financial institutions. It’s tailored to meet the complex needs of large banking corporations.

- Pricing

The starting price is $50 per month for the Starter Growth Suite. This package likely includes more features than the free version and is designed for businesses ready to grow further.

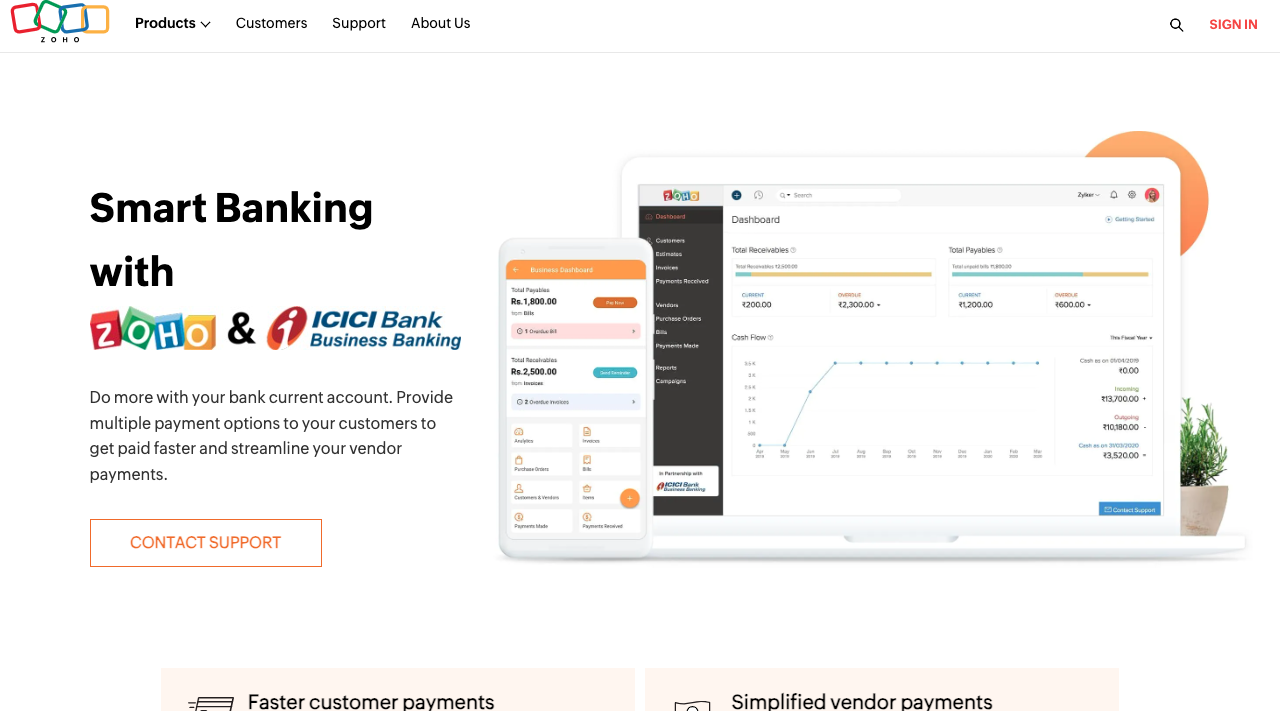

3. Zoho CRM

Image Source: Zoho CRM

- Smart Selling with Conversational AI

Zoho uses artificial intelligence (AI) to improve the way sales staff talk with customers. It’s like having a smart assistant that helps you communicate better and understand your customers’ needs more effectively.

- Omnichannel Customer Interaction

This feature allows you to communicate with your customers through different methods like email, phone calls, and social media, all in a smooth and integrated way. It’s like having one tool to manage conversations across all platforms.

- Intelligent Alerting System

The software automatically sends you notifications about important events or actions. This is like having a reminder system that keeps you updated on critical information without you having to check constantly.

- Multiple Pipeline Management

This is about organizing and keeping track of various banking services and products. It helps you manage different aspects of your business, like loans, accounts, or credit services, in a more organized way.

- Mobile MDM & SDK

The software provides tools for managing mobile devices (MDM) and a set of tools for developers (SDK) to enhance the use of the CRM on mobile phones. It’s like having special features that make the software work better and more securely on smartphones.

- Pricing:

Standard Plan: It starts at ₹944 per month for each user. This is likely the basic plan with essential features.

CRM Plus Plan: Priced at ₹4130 per user per month, this plan offers more advanced features, suitable for businesses that need more comprehensive tools.

4. ActiveCampaign

Image Source: ActiveCampaign

- Marketing Automation

Active Campaign CRM tools like autoresponders (automatic replies to customer actions), goal tracking (measuring the success of marketing activities), and the ability to send marketing messages across different channels like email, social media, etc.

- Advanced Segmentation

This allows you to divide your customers into detailed groups based on things like their interests, behaviors, or demographics. It’s like creating specific lists of customers based on what you know about them.

- Machine Learning Tools

These tools include features like split automation (testing different marketing strategies to see which one works best) and predictive sending (figuring out the best time to send messages to customers for maximum impact).

- Calendar Integration

The software can be connected with Google and Outlook calendars, making it easier to schedule and track marketing activities.

- Target Audience

This software is particularly suitable for medium to large institutions that need a variety of marketing tools and want to reach their customers through multiple channels.

- Pricing

The Lite plan starts at $9 per month. This is likely a basic version of the software with essential features for smaller-scale operations.

5. Pipedrive

Image Source: Pipedrive

- AI Sales Assistant

Pipedrive is like having a smart helper that gives you advice on how to make your sales process and automation better. It uses artificial intelligence to analyze your sales activities and suggest improvements.

- Email Marketing Tools

These tools allow you to send emails to groups of people, use pre-designed templates to make your emails look professional and track how well your emails are doing (like seeing who opened them and clicked on links).

- Client Data Management

This feature helps you collect and organize detailed information about your clients. It also helps you figure out which clients are more likely to buy (priority leads), so you can focus more on them.

- Customizable Pipelines

This allows you to create and adjust your own systems for managing sales deals. It’s like having a flexible method to track different stages of a sale, from the first contact to closing the deal.

- Target Audience

This software is especially designed for banks that want to focus on automating their marketing and sales processes. It’s tailored for financial institutions looking to streamline these areas.

- Pricing

The Essential Growth plan begins at $12.50 per month. This likely includes basic features suitable for smaller-scale needs or businesses just starting with sales automation.

Each of these CRM solutions offers unique features tailored to the banking sector. From managing customer relationships to automating marketing efforts and enhancing service delivery, these tools are designed to streamline operations and improve customer engagement.

Unlock Your Business Potential With Expert HubSpot Support!

For banks seeking a comprehensive solution to their CRM challenges, HubSpot emerges as a prime choice. HubSpot offers a holistic platform that addresses the abovementioned challenges and enhances customer relationship management.

As a HubSpot Solutions Partner we take pride in assisting you with streamlining your HubSpot efforts. With our best-in-class marketing, sales, and service solutions, we help you scale exponentially. INSIDEA’s HubSpot Specialists have the required in-depth knowledge and can provide you with expert guidance on how to use the platform to meet your specific business needs.

Get in touch today to learn more about how INSIDEA can help you succeed!

- Tailored Experience: For us, user experience is the primary focus. Thus, INSIDEA works with you to ensure your HubSpot experience is tailored to your business needs.

- Industry Expertise: Our team specializes in the setup, implementation, and optimization of HubSpot tools, as well as being well-versed in HubSpot best practices to ensure your business has the highest ROI possible.

- Customer Obsession: For us, customer satisfaction is the key to success, and we strive to ensure that our customers’ needs are not only met but exceeded every time.

At INSIDEA, we understand the importance of valuable HubSpot strategies that understand your target audience and drive conversions. Book a meeting with our experts to explore how we can help you with your upcoming projects.

Get started now!