Are you on the lookout for an accounting virtual assistant but are unsure if it is worthwhile to hire one?

You have found the perfect guide to help you decide.

Handling your finances is crucial, and working with an accounting virtual assistant offers a strategic edge over traditional staffing methods. Tailored to your unique business requirements, INSIDEA specializes in providing top-tier accounting virtual assistants. Discover how our expert VAs can be a transformative asset for your accounting needs.

In this blog, we will explore the essential role of accounting virtual assistants in laying the pathway for your business’s growth. We will cover:

- What exactly is the role of an accounting virtual assistant?

- What variety of tasks can an accounting virtual assistant undertake?

- What specific skills do accounting virtual assistants possess?

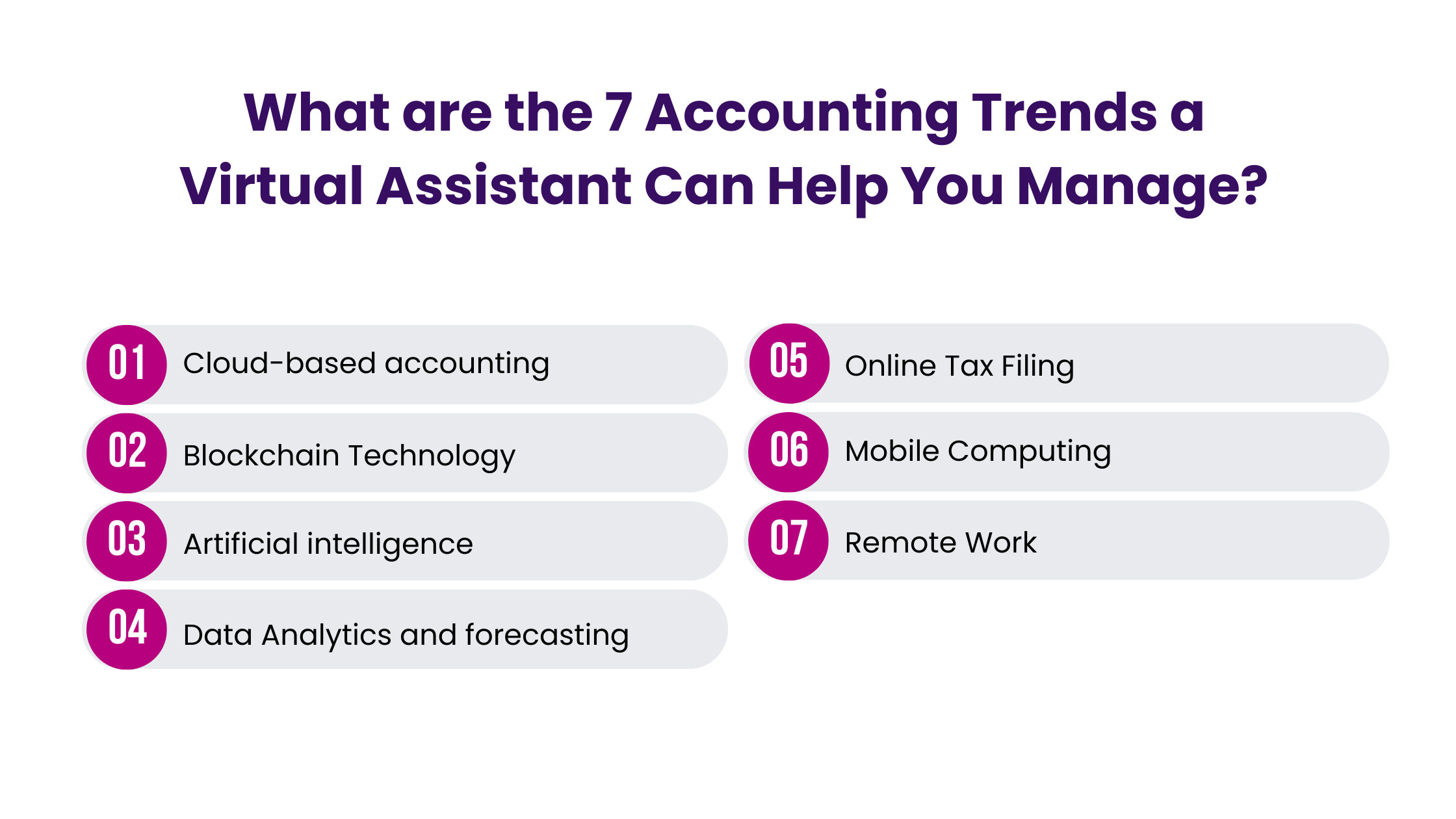

- What are the 7 accounting trends a virtual assistant can help you manage?

Let’s dive in!

What Do We Mean by an Accounting Virtual Assistant?

An accounting virtual assistant is a professional who remotely offers bookkeeping and accounting services to businesses. They are skilled in managing financial transactions, ensuring accounts are accurately reconciled, and preparing detailed financial statements. These assistants are proficient in various accounting software and tools, making them an effective and cost-efficient solution for businesses, especially small ones, needing financial management assistance without the expense of a full-time accountant.

What Variety of Tasks Can an Accounting Virtual Assistant Undertake?

An accounting virtual assistant is integral in managing various financial aspects of a business. These tasks include:

- Financial Data Management: They classify, compute, and record financial data.

- Account Verification: This involves calculating, checking, and verifying account accuracy.

- Data Accuracy Checks: They ensure the correctness of data entered by others.

- Invoice Preparation: VAs create invoices and maintain account ledgers.

- Bill Management: They are responsible for timely bill payments.

- Reconciliation: Balancing statements for bank accounts, vendors, and credit/debit cards is a key task.

- Transaction Processing: Handling documents for receivables and payables.

- Financial Reporting: Preparing balance sheets and profit and loss statements.Generating and analyzing financial statements.

- Bookkeeping and Data Entry: Organizing financial records and maintaining ledgers.

- Expense Management: Tracking expenses and preparing reports.

- Payroll Processing: Managing wages, deductions, and compliance.

- Tax Preparation and Compliance: Assisting in tax return preparation and ensuring compliance with tax laws.

Each of these tasks is critical to maintaining a business’s financial health and compliance.

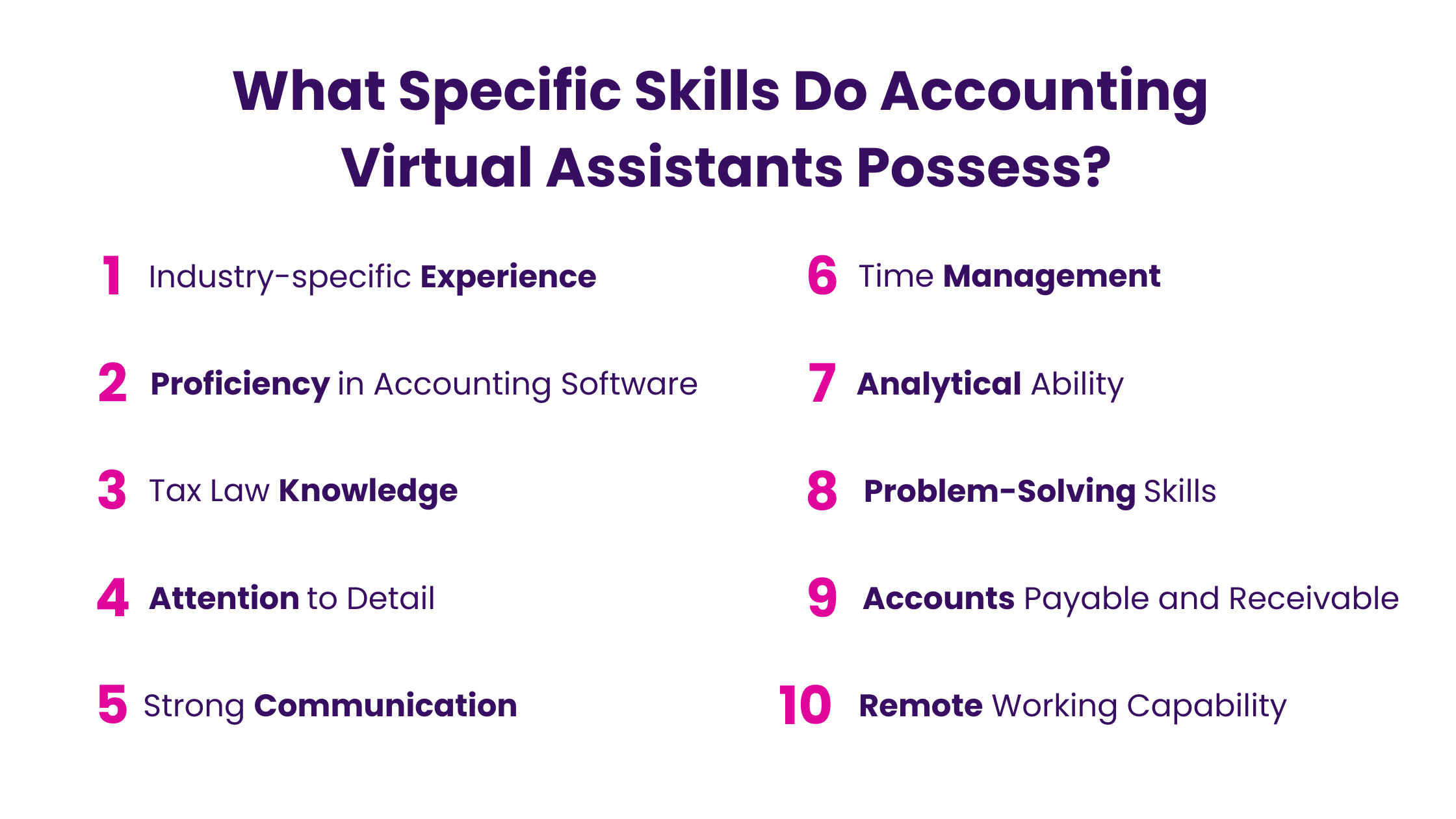

What Specific Skills Do Accounting Virtual Assistants Possess?

When hiring an accounting virtual assistant, it’s crucial to ensure they possess a comprehensive skill set to handle your business’s financial needs effectively.

Skills to Look for in an Accounting Virtual Assistant

- Industry-specific Experience: Accounting and bookkeeping experience in specific industries is essential for handling unique financial aspects of your business sector.

- Proficiency in Accounting Software: Familiarity with tools like Xero, and FreshBooks is vital.

- Tax Law Knowledge: Understanding tax regulations ensures compliance.

- Attention to Detail: This is critical for accurate financial reporting.

- Strong Communication: Both written and verbal skills are important for clear correspondence.

- Time Management: Necessary for handling multiple tasks and deadlines.

- Analytical Ability: To interpret financial data and spot trends.

- Problem-Solving Skills: Important for resolving financial issues.

- Accounts Payable and Receivable Experience: A key aspect of managing finances.

- Remote Working Capability: Essential for a virtual role.

When considering an accounting virtual assistant, it’s essential to ensure their availability aligns with your time zone for smooth collaboration. Budget alignment is also crucial to avoid overspending. Look for VAs with experience relevant to your industry for more effective assistance. Prefer VAs who can dedicate focused attention to your project rather than managing multiple clients simultaneously. Lastly, check their online reviews to gauge their reliability and performance quality.

Your goal is to find an accounting virtual assistant who is skilled in accounting and passionate about it, ensuring trust and reliability in managing your books and finances.

What are the 7 Accounting Trends a Virtual Assistant Can Help You Manage?

The misconception that businesses must operate in-person to succeed is challenged by the rise of remote work and technological advancements. Accounting, a critical business function, is evolving with these changes. Technology, particularly cloud-based solutions and AI, play a crucial role in modernizing accounting practices. This shift also includes operational changes like outsourcing. This article delves into these transformative accounting trends, highlighting how they enable businesses to thrive in a remote setup.

1. Cloud-based accounting

It simplifies financial management, offering real-time data access and boosting transparency and teamwork. It streamlines monitoring expenses and inventory management. The technology is cost-effective and scalable. An expert accounting virtual assistant can guide you using cloud-based platforms, easing the financial management process and helping team members adapt to this technology.

2. Blockchain Technology

Blockchain technology is increasingly integrated into finance and accounting. Its secure, transparent ledger system is beneficial for external auditing and transaction accuracy. An accounting virtual assistant utilizing blockchain can efficiently handle data recording and ledger maintenance, enhancing time and cost efficiency for businesses.

3. Artificial intelligence

Artificial intelligence significantly enhances productivity and streamlines accounting tasks. A virtual assistant can efficiently manage large data volumes using AI, which is particularly beneficial for growing businesses. They can assist in selecting the ideal AI tool, like robotic process automation (RPA), to automate mundane tasks.

4. Data Analytics and forecasting

In data analytics and forecasting, the shift from traditional methods to advanced technology enables more precise analysis and projections. This accuracy aids in strategic business decision-making. A VA skilled in these tools can analyze data, easing the workload and focusing on core business strategies.

5. Online Tax Filing

Online tax filing tools allow businesses to manage tax obligations digitally, avoiding in-person queues. These tools not only automate tax filing but also simplify bookkeeping. Enlisting a virtual accounting assistant can enhance this process. They are skilled in ensuring accuracy in tax filings, maintaining orderly records of tax returns, and preemptively addressing potential accounting discrepancies, thus streamlining your business’s tax management efficiently.

6. Mobile Computing

As technology progresses, mobile computing becomes crucial in providing accounting services. This approach not only appeals to a broader client base but also caters to the needs of those constantly moving. An accounting virtual assistant proficient in mobile computing ensures smooth financial transactions and enhances customer satisfaction through interaction with your business’s mobile accounting services.

7. Remote Work

Since the pandemic, the shift to a remote workforce has become a game-changer. It’s not just about cutting costs or tapping into a wider pool of talent; it’s about embracing a new way of working that’s here to stay. I’ve seen how big and small businesses are now leaning on virtual assistants for tasks like managing inventory and sorting out financial data. It’s all about boosting efficiency and scaling up smartly.

Case Study: Transforming John’s Restaurant with a Skilled Accounting Virtual Assistant

Meet John, the owner of a bustling restaurant in a vibrant city. His establishment is well-regarded for its exceptional cuisine and warm ambiance. However, John was overwhelmed by the financial intricacies of running his restaurant. He was inundated with tasks like tracking expenses, managing payroll, and ensuring tax compliance, leaving little time to focus on culinary excellence and customer experience.

The Challenges of Financial Management

John’s expertise lies in the culinary arts, not accounting. He spent hours weekly trying to balance books, process employee wages, and handle vendor invoices. This drained his energy and led to occasional errors in financial records, impacting his decision-making ability.

The Solution: An Accounting Virtual Assistant

After careful consideration, John hired an accounting virtual assistant specializing in the hospitality industry. The VA brought a wealth of experience in managing finances for restaurants, including familiarity with industry-specific accounting software and practices.

Strategic Financial Planning and Execution

The VA began by streamlining John’s bookkeeping processes. They managed accounts payable and receivable, meticulously tracking every transaction related to the restaurant. They implemented a more efficient payroll system and ensured compliance with tax regulations, which was crucial for John’s peace of mind.

Impactful Financial Insights

The VA provided John with weekly financial reports, offering a clear view of his cash flow, expenses, and revenue. This insight was pivotal in helping John make strategic decisions, such as identifying profitable menu items, optimizing supplier contracts, and controlling overhead costs.

Outcomes: A Flourishing Business

The introduction of the accounting VA was transformative for John’s restaurant. With the VA handling financial intricacies, John could refocus on his passion for cooking and enhancing customer service. His restaurant saw an uptick in efficiency, customer satisfaction, and profitability.

Reinvestment and Growth

The VA’s role extended beyond day-to-day accounting. They assisted John in financial planning, leading to strategic reinvestments in the restaurant. This included upgrading kitchen equipment, enhancing the dining area, and investing in marketing initiatives, further boosting the restaurant’s popularity and revenue.

Thus hiring an accounting VA proved to be a strategic decision for John’s restaurant. It streamlined financial management and provided the foundation for informed decision-making and sustainable growth. John’s story is a testament to how skilled virtual assistance in accounting can revolutionize a business, allowing owners to focus on their core competencies and passions.

Redefine Business Efficiency With INSIDEA’s Virtual Assistant Solutions

Investing in virtual assistant services yields significant returns, considering their many advantages for your business. By incorporating skilled virtual assistants into your customer service strategy, you not only elevate the quality of your customer interactions but also pave the way for enhanced customer loyalty and overall business success. Virtual assistants are more than just a resource; they are a transformative element in customer service, driving your business toward its goals with efficiency and expertise.

Are you looking to enhance your business operations with unparalleled efficiency and expertise? INSIDEA is here to guide you through the world of virtual assistant services, offering tailored solutions that cater precisely to your business needs. Connect with us now to explore how our virtual assistant expertise can be a game-changer for your business success!

Tailored Solutions: Understanding that each business has unique challenges and objectives, INSIDEA specializes in crafting personalized virtual assistant strategies. We align our services with your business requirements, ensuring a perfect fit for your operational needs.

Industry Expertise: Our team is not just skilled; they’re seasoned experts in virtual assistance. With a deep understanding of various industries, we bring you the best practices, cutting-edge tools, and insights to maximize the effectiveness of your virtual assistant services.

Customer Commitment: At INSIDEA, your business goals are our mission. We are committed to empowering your business with virtual assistants who are skilled and aligned with your vision, driving your business toward remarkable achievements.

Ready to unlock the full potential of your business with expert virtual assistant services? Book a meeting with our experts today and start your journey towards redefining business efficiency