Are you in the financial services industry overwhelmed by the complexity of managing client relationships, marketing, and sales?

Using HubSpot for financial services is an indispensable tool in how financial advisors streamline their operations. This powerful tool is a comprehensive solution designed to meet the unique needs of the financial sector.

HubSpot CRM is designed to cater specifically to the needs of financial advisors. With its seamless integration of marketing, sales, and service tools, HubSpot for financial services simplifies complex processes, making day-to-day operations more efficient and client interactions more impactful.

So, let’s dive in and discover how HubSpot for financial services can transform your business, streamline your operations, and help you provide top-tier financial advice with unparalleled efficiency and ease.

Why Using HubSpot for Financial Services is the Optimal Choice for You?

Source: HubSpot

HubSpot stands out as a comprehensive solution, offering a blend of features that cater specifically to the needs of financial advisors.

With its user-friendly interface and various functionalities, HubSpot simplifies client relationship management, marketing, and sales processes, making it an indispensable tool for financial professionals.

Let’s explore why using HubSpot for financial services is the preferred choice for financial advisors.

1. Integrated Tools and Teams

HubSpot offers a centralized hub for all digital marketing tools, including GSuite, Outlook, WordPress, Slack, and social media integrations. This integration ensures that data is shared effectively, eliminating data silos and providing a comprehensive view of business health.

2. Effortless File Exporting

The platform simplifies data management with its easy-to-use file manager, allowing for quickly importing and exporting essential files. This feature is particularly useful for compliance and reporting purposes.

3. Professional Landing Page Creation

HubSpot’s free landing page builder enables financial advisors to create sleek, professional pages without coding. These pages are essential for lead generation and can be effectively tracked and optimized for maximum conversion.

4. Automated and Optimized Workflows

The CRM enhances productivity with automated workflows that specific dates or events can trigger. HubSpot’s advanced if/then logic and performance measurement tools make these workflows sophisticated and effective.

5. Flexible Pricing Structure

HubSpot’s pricing is designed to grow with your business, offering a free tier with substantial features and the option to upgrade as needed. This flexibility makes it an ideal choice for financial advisors at any stage of their business.

6. Uncompromised Data Security

Recognizing the sensitivity of financial data, HubSpot ensures top-tier security with encryption, TLS, and robust firewalling, making it a trustworthy platform for managing client information.

7. User-Friendly Interface

The CRM is known for its intuitive dashboard and clean interface, complemented by free online tutorials. This ease of use ensures that all team members can leverage the CRM effectively, maximizing its benefits.

8. Advanced Email Campaign Management

HubSpot provides comprehensive tools for creating, tracking, and optimizing email campaigns. Features like email tracking, segmented contact lists, design templates, and built-in analytics empower financial advisors to execute successful email strategies.

HubSpot for Financial Services offers a multifaceted platform that addresses financial advisors’ unique challenges for enhancing client relationships and driving business growth.

10 Benefits of Utilizing HubSpot for Financial Services

In the evolving financial services landscape, leveraging the right technology is crucial for success. HubSpot stands out as a versatile and powerful tool, offering a range of features specifically designed to enhance the operations of financial service providers.

Here is how your business can utilize HubSpot for financial services:

- Lead Acquisition and Qualification

HubSpot excels at generating new leads with its array of marketing tools. Financial advisors can utilize email marketing, landing pages, and blogging integrated into one platform to attract and qualify potential clients.

- Client and Prospect Nurturing

Financial firms can effectively nurture client relationships with HubSpot’s automation tools, such as triggered emails. These tools help educate potential clients about services and the value of partnering with the firm.

- Sales Pipeline Management

The intuitive deals pipeline in HubSpot provides a clear overview of sales performance. Its drag-and-drop interface allows for easy tracking of deal stages, helping to manage and forecast sales effectively.

- Gaining Client Insights

HubSpot’s built-in CRM offers deep insights into client and site visitor behavior. It records interactions from email engagement to website activity, centralizing all crucial information.

- Streamlining Sales Processes

Insights from contact records in HubSpot can be used to streamline sales processes. Automated notifications to assigned team members when contacts take action can significantly reduce response times.

- Identifying Cross-Selling Opportunities

Easy access to client activity and timely notifications enable teams to recognize and act on cross-selling opportunities, tailoring their approach based on client behavior.

- Enhancing Client Experience

HubSpot helps understand and address friction points in the client journey. Its personalization capabilities and automation tools provide a more enjoyable and efficient client experience.

- Seamless Platform Integration

HubSpot simplifies the integration of various software tools, including Gmail and Outlook, for email tracking and logging client communications directly within the CRM.

- Robust Reporting and Analytics

With its advanced reporting tools, HubSpot allows financial firms to monitor and analyze sales and marketing activities, providing a comprehensive view of business operations.

- Improving Technology Adoption

To maximize the benefits of HubSpot, it’s essential to encourage team adoption. Regular communication, demonstrations, appointing technology ambassadors, and providing training can significantly enhance the team’s engagement with the platform.

Using HubSpot For Financial Services: Elevate Financial Business with Powerful Solutions

Using HubSpot for financial services provides a comprehensive suite of tools essential for financial service providers.

It encompasses everything from lead generation to client relationship management and operational analytics, equipping financial advisors with the necessary resources to excel in a competitive market.

I. HubSpot Marketing Hub

1. Email Marketing: Create and send customized email campaigns that cater to the unique financial needs of different client segments. Utilize templates and personalization tokens to address clients by name or reference their specific financial interests.

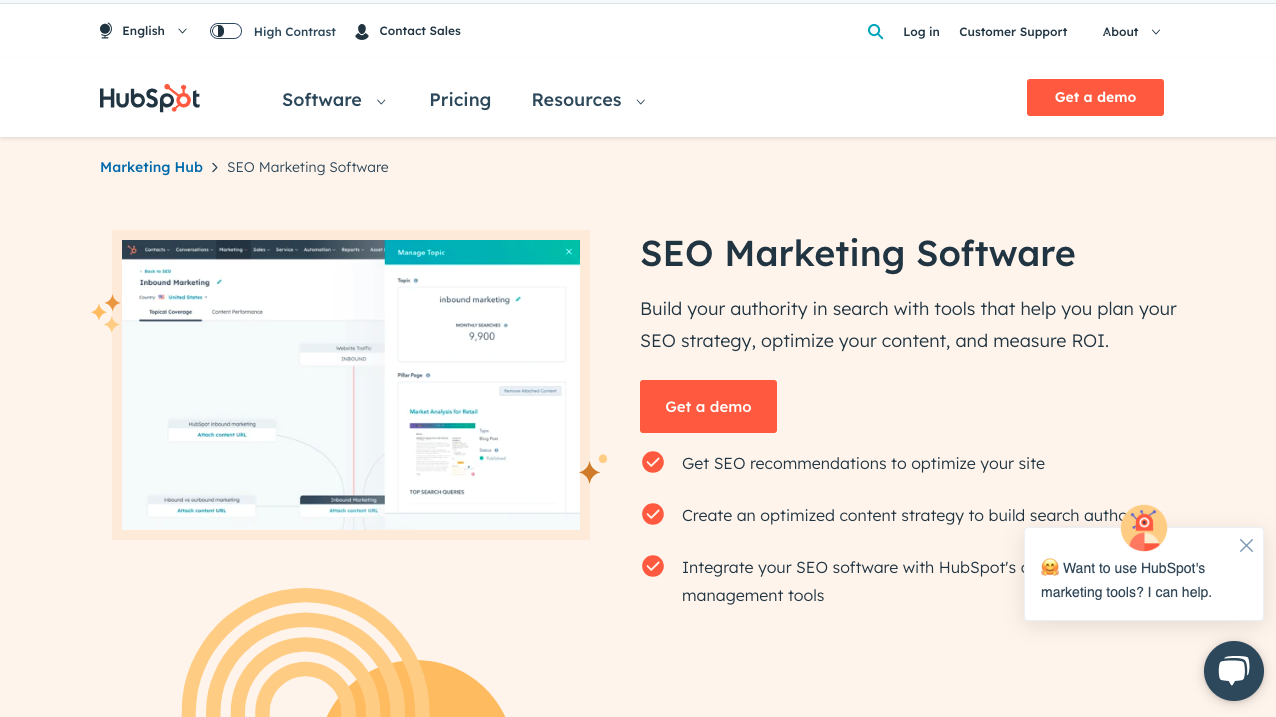

2. SEO Tools

Image Source: HubSpot

Optimize your website content to rank higher in search engine results for keywords related to financial services. This includes optimizing blog posts, landing pages, and website pages to attract more organic traffic seeking financial advice or products.

3. Social Media Tools: Manage social media campaigns across different platforms. Schedule posts, track engagement, and analyze the performance of content related to financial services. This helps target the right audience and understand what type of content resonates with them.

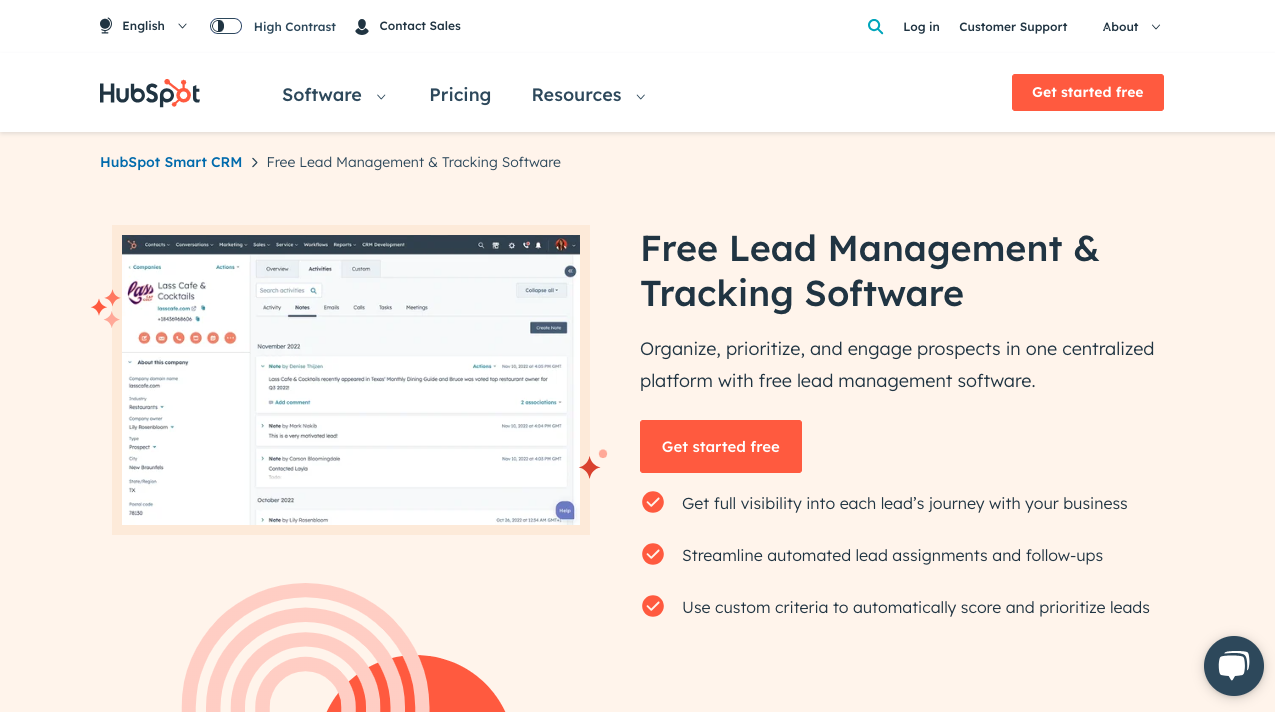

4. Lead Management

Source: HubSpot

Capture leads through forms, landing pages, and lead flows. Track interactions and tailor the marketing efforts to convert these leads into clients for your financial services, using segmentation and scoring to prioritize follow-up.

II. HubSpot Sales Hub

1. CRM: Maintain detailed records of client interactions, preferences, and history. In financial services, this is crucial for tailoring advice, managing investment portfolios, or tracking the progress of a loan application.

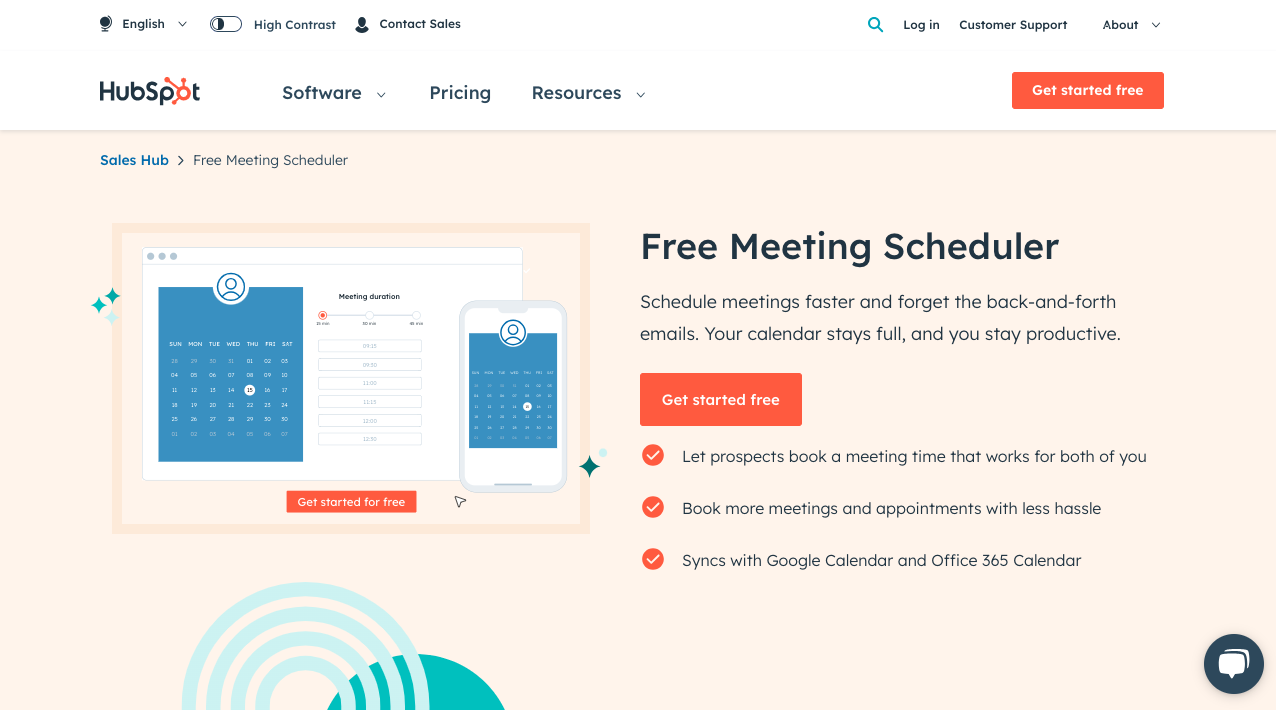

2. Meeting Scheduling

Source:HubSpot

Embed meeting links in emails or on your website, allowing clients to book appointments directly into your calendar. This feature is particularly useful for setting up consultations, financial planning sessions, or reviews of client portfolios.

3. Email Tracking and Engagement Notifications: Receive real-time notifications when a client opens an email or clicks a link. This insight is valuable for understanding client interest and timing follow-up communications effectively in a financial context.

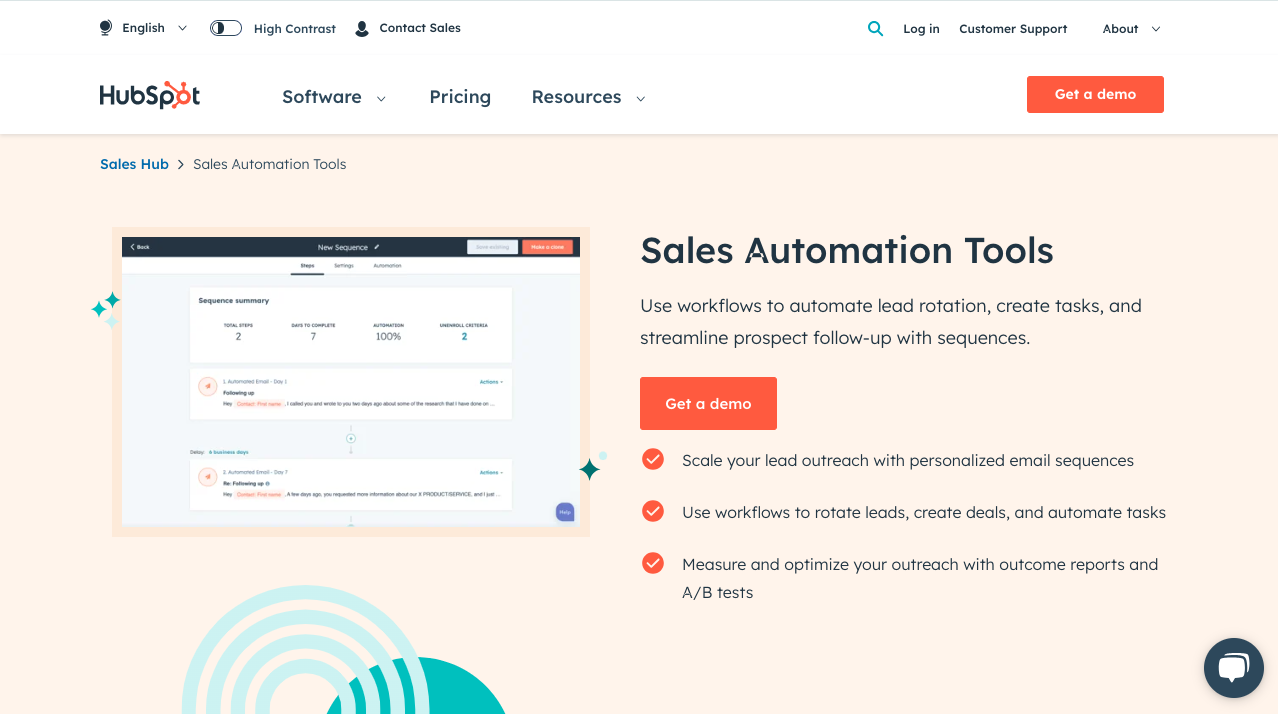

4. Sales Automation

Source: HubSpot

Automate repetitive sales tasks like follow-up emails or task reminders. This ensures that financial advisors or sales reps can focus more on personalized client interactions and less on administrative tasks.

III. HubSpot Service Hub

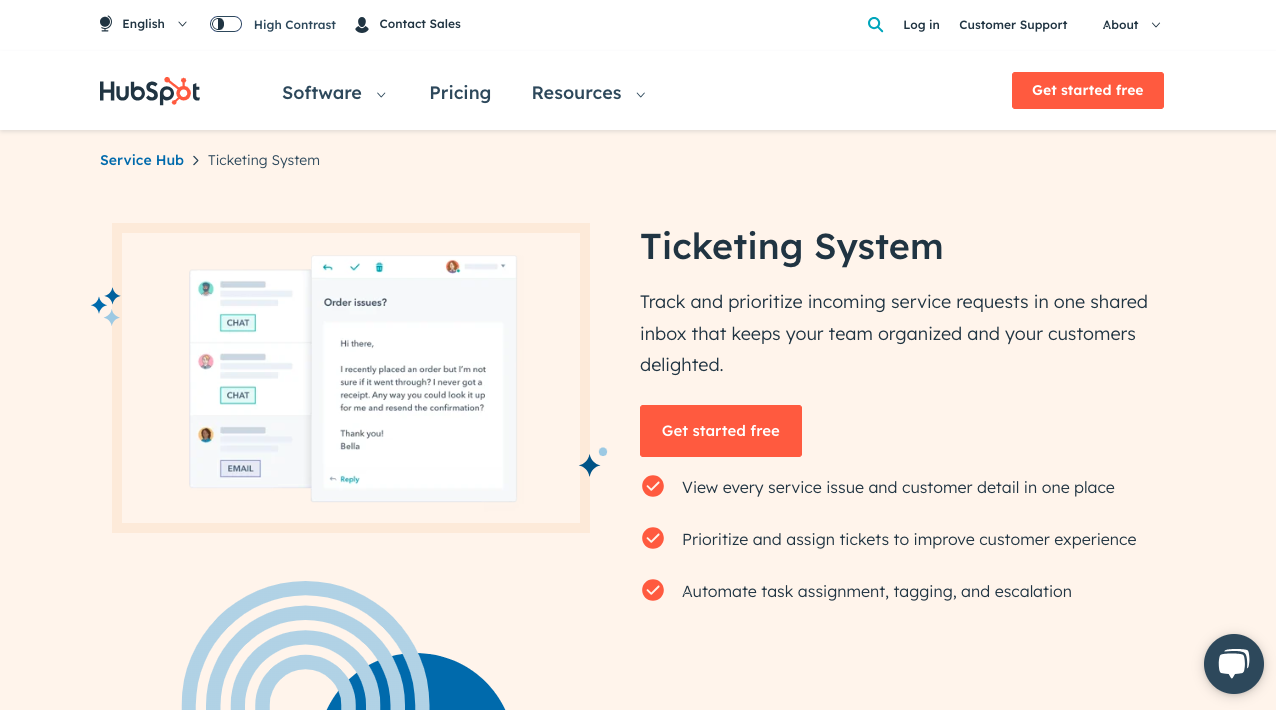

1. Ticketing System

Source: HubSpot

Create and manage support tickets for client inquiries or issues. This can be used to track and resolve issues like disputes over charges, requests for account changes, or inquiries about financial products.

2. Knowledge Base: Build a repository of helpful articles and resources. For financial services, this could include explanations of complex financial concepts, step-by-step guides for services like online banking, or FAQs on common financial questions.

3. Customer Feedback Tools: Collect and analyze client feedback through surveys and feedback forms. This can help financial institutions gauge client satisfaction, understand the needs of their market, and make informed decisions about service improvements.

4. Live Chat and Chatbots

Source: HubSpot

Provide immediate assistance through live chat or programmed responses from chatbots. This is particularly useful for answering common questions about financial products or services, providing quick guidance on navigating online services or escalating complex issues to human agents.

HubSpot provides financial services businesses with tools to attract, engage, and support clients effectively. These features simplify lead generation, sales management, and customer support, ultimately helping financial firms provide exceptional services to their clients.

Using HubSpot for financial services is a game-changer for financial advisors aiming to upgrade their operations. This all-in-one, user-friendly platform integrates diverse functionalities, streamlining daily tasks while providing deep analytics and strong security.

It ensures financial advisors are fully prepared to address the dynamic needs of the industry. Adopting HubSpot for financial services represents a strategic shift towards a more structured, client-focused, and data-oriented methodology in financial advisory services.

Unlock Your Business Potential With Expert HubSpot Support!

As a HubSpot solutions partner we take pride in assisting you with streamlining your HubSpot efforts. With our best-in-class marketing, sales, and service solutions, we help you scale exponentially.

INSIDEA’s HubSpot specialists have the required in-depth knowledge and can provide you with expert guidance on how to use the platform to meet your specific business needs.

Get in touch today to learn more about how INSIDEA can help you succeed!

- Tailored Experience: For us, user experience is the primary focus. Thus, INSIDEA works with you to ensure your HubSpot experience is tailored to your business needs.

- Industry Expertise: Our team specializes in the setup, implementation, and optimization of HubSpot tools, as well as being well-versed in HubSpot best practices to ensure your business has the highest ROI possible.

- Customer Obsession: For us, customer satisfaction is the key to success, and we strive to ensure that our customers’ needs are not only met but exceeded every time.

At INSIDEA, we understand the importance of valuable HubSpot strategies that understand your target audience and drive conversions. Book a meeting with our experts to explore how we can help you with your upcoming projects.

Get started now!